If it is to be believed that every event in one’s life happens in a way that all the dots connect to the present moment, then Ng Keng Hooi’s many life experiences have led him right where he is supposed to be. Making corporate history as the first Malaysian to helm a global financial services organisation – the second largest in the world – Ng cuts a modest yet firm figure as the new Group CEO at AIA, taking up the reins from Mark Tucker with a quiet knowledge and assuredness.

Tucker, who relinquished his position at AIA last month, led the company from its IPO in 2010 and is largely credited for the new business growth of the company from USD667 million from that year to USD2,750 million last month. His decision to retire from AIA and, subsequently, join HSBC as Chairman, left many with the assumption that Ng had big shoes to fill, with AIA shares dropping by 3.3 per cent in Hong Kong at the time of the announcement (market confidence has since risen sharply with the share price rebounding 13 per cent shortly before Ng officially assumed the leadership role on 1 June).

What is more accurate, however, is that both men are long-time associates and veterans in the industry, with the fruits of their labour shared in mutual advice, support and recognition.

“Mark and I have been together for more than 20 years – he’s a mentor and a good friend, and I have to thank him for where I am today,†says Ng. “A lot of things that are happening in AIA today had been done together with him and the strategies we’ve put in place have worked – we have grown at an annual compounded rate of 28 per cent since AIA’S IPO.

“There’s no reason why we should make a huge change from [our strategy] – much of what we do is sustainable,†Ng continues, when asked if he would do things differently from his predecessor. “But over time, we will continue to look at ways to improve the business.â€

Tucker has lent his support of Ng in an official statement from AIA: “I have worked closely with Keng Hooi… and admire him as an executive with an exceptional track record of strong execution and commercial experience in the Asian region.â€

At the time of this interview, Ng’s new position had already been accelerated, coming into effect in June. This is small wonder given his own reputation in the industry as an effective decision maker, even in the most tense and fragile of circumstances.

Two major incidences have significantly cemented Ng’s standing in the industry. During the Asian financial crisis in 1997, Ng, together with Tucker, was instrumental in helping the company they were previously in, Prudential, gain an eventual 100 per cent stake in its Malaysian arm in an effort to stem the outflow of foreign capital.

In 2009, as the newly appointed Chief Executive of Great Eastern Life, Ng had successfully thwarted a potential meltdown the size of Lehman Brothers. At the height of the global financial crisis, he helped

mitigate some 18,000 Singaporean investors at Great Eastern Life’s expense totalling around MYR600 million, redeeming retail investment products linked to collateralised debt obligations when the underlying bonds that backed the products caved.

“Outside of Singapore and Malaysia, most people do not know me that well,†says Ng, decidedly modest as he talks of the initial reaction to his appointment from the market. “A lot of people want to know, ‘Who’s this guy?!’ But once they do, they’ll know that I’m very involved in the business. To me, CEOs are in a very privileged position – we can do things that can change the lives of people and for that reason, we have to be very people-focused. If I can inspire people to do better, then I’m doing the right thing.â€

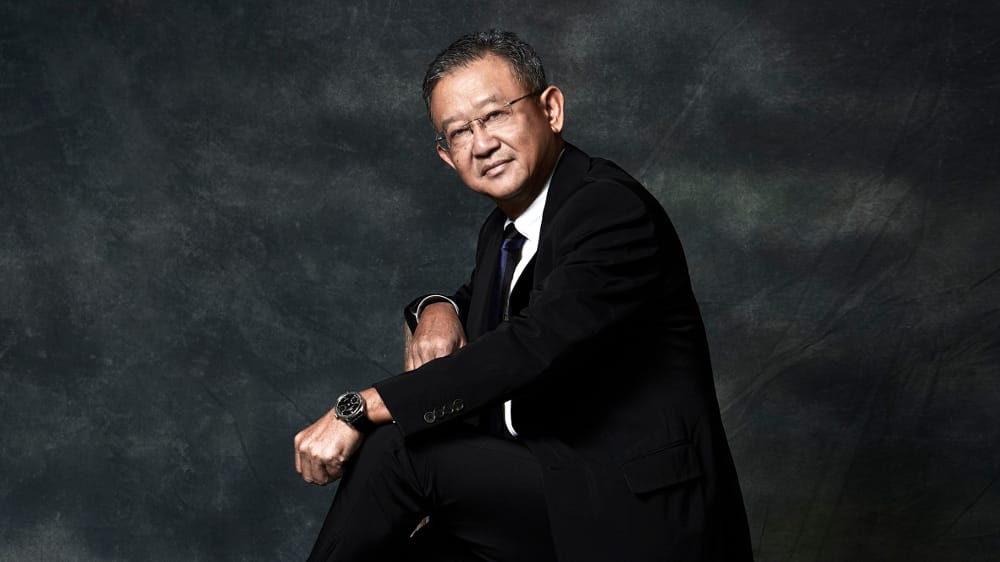

Ng is sitting across from me in one of the boardrooms at the AIA Bhd headquarters in Kuala Lumpur. While he comes across as reserved at the outset, he turns out to be rather chatty and personable. The Group CEO is suitably dressed in a Prada suit and tie. “My wife’s doing,†he laughs. “We’ve been married 30 – I have to be careful here – more than 30 years ago and she’s one of the two most important women in my life. My wife and mother have both made huge contributions to where I am today.â€

As a small town boy from Raub, Ng could not have foreseen how the dots would connect so providently for him. Born into a family of eight siblings, Ng’s formative years were humble, to say the least. Ng’s father served as a supervisor in the army camp in Raub while his mother was a homemaker. It is to Ng’s mother’s credit that all eight siblings have turned out to be incredibly successful.

“The big thing for my mum was education – it was absolutely non-negotiable. My youngest brother is a cardiologist in Raub. My eldest brother is one of the first few quantity surveyors in the country. My brothers and sisters in between are made up of engineers and other professionals. All this is due to her.”

Ng eventually earned a place at the prestigious Royal Military College – Malaysia’s equivalent to Sandhurst – in Kuala Lumpur. There, he would encounter a turning point brought about by a teacher. “I had a maths teacher by the name of Chakrawati who told me, ‘You’re so good at maths, you should become an actuary’. I followed his advice, did my professional exams, became an actuary and that’s how I ended up in the insurance industry. I still meet up with Mr Chakrawati!â€

His family places importance on one other trait: “Humility is important – a small town guy can make it big so long as he is supported by family and he stays grounded.†It could well be another dot connecting him to the business of people and Ng does not pay lip service to the idea of ‘People First’.

Mark and I are always talking about people. While we want to build a successful business, it is also about developing and growing them. Quite a few have joined me here [at AIA from the other organisations where Ng has worked] and grown with me over time.

“I’m proud to say that I build people,†he continues. “At AIA, we are constantly making sure that we get the best and then give them the opportunity to grow and deliver. If they do well, we recognise them. Look at AIA Malaysia’s CEO Anusha (Thavarajah). We brought her in post-IPO and she was the CFO then. Anusha is an example here but we do that in many of our other countries. I’m very pleased to say that out of the eight new appointments we’ve had at a senior level, seven of them are internal promotions. One of them is a returnee.â€

In fact, Ng’s own appointment had already been given due consideration long before Tucker’s retirement. “The Group Board has succession plans for its staff and it goes all the way to the top. Some companies are not able to deliver [on recognising and promoting staff ] when it comes to the [highest positions]. In this company, we have a process – the Organisation People Review – that we do twice a year in which we ask who the potential successors are and where are the gaps.

“AIA is a very inclusive company – everything is based on meritocracy,†Ng continues. “We emphasise a lot on locals in all the markets we operate in. Where we can get the best locals, we will, but when we can’t, we would not hesitate in bringing foreign expertise into the company.†He goes on to cite AIA Malaysia as being “very fortunate –we have a lot of local talent and most of the senior positions are local.â€

In his new capacity, Ng is in charge of the largest independent listed company on the Hong Kong Stock Exchange, serving holders of more than 30 million individual policies and over 16 million group insurance scheme members. Naturally, Ng is mindful of the future of AIA, particularly in immersing the company in a digital space, identifying this as a viable platform from very early on, in its attempt to attract a new generation of customers.

“We’ve embarked on the digital journey for a number of years since the IPO. We equip our agents with an iPad to do their business and we’re going to see more innovations moving towards the smartphone,†he says. “For example, we have apps that can allow our customers to check where the hospitals are for claims.â€

He also cites the example of AIA Vitality. “This started in South Africa which happens to be where we are seeing a lot of innovation in insurance. AIA Vitality currently has over 40,000 members in Malaysia and it is about wellness. It’s our way of transforming our business – our agents can engage the customer about wellness and persuade them to live more healthily. If they do, our customers are rewarded with benefits, lower premiums and the like.

“AIA is a longstanding brand and while the older generations definitely know us, we want to make sure that we reach out to the younger ones as well,†he says. “This is our future. These are the people who would grow up, have families and need protection. We need to connect with them and be more visible to them.â€

The company is certainly seen as a market leader – and expert – in the region, protecting its people with a total sum assured of over USD1 trillion. “We are strong in Asia, we know Asia well and there’s a huge opportunity here and a rising middle class here,†Ng affirms. “In insurance, whenever someone hits an income of USD10,000 a year, we believe that they are our potential customers. The bracket hitting this level is huge. The numbers are increasing everywhere in Asia and this region remains the most attractive market. A lot of European and American companies want to tap into this market – this is where the future is.â€

AIA’s focus remains firmly on insurance, he says. “We are good in life insurance and we do it well. We are not going to fool ourselves and try to get into non-life insurance areas,†says Ng. “We recognise ourselves for what we are. We can’t play in a market that is alien to us and we are entirely focused on Asia.†He acknowledges that there’s plenty of scope for AIA to look at. “We still see claims being paid at an average of MYR50,000. That’s too low; we should be talking about 10 times that sum assured. People are not buying enough protection,†says Ng but admits that they “need to be persuaded.â€

“They do think about the future but they don’t wake up and say, ‘I want to go to the insurance company to protect my family’ – it’s not a natural thing.â€

Doubtless, the journey that Ng has taken also sees him taking a principled view in the way he does business, as seen with his handling of the two economic crises, and also his overview of work and work culture. His definition of success comes back to people. “Why should I be in this position if I’m not able to help?†he says. “Of course, I’m very business driven and I drive the business hard but this is not in contradiction with helping someone. Inspiring people to do better is a lifelong journey for me. Someday, when I’m done with this role, I’d probably continue to go in that area and see how I can help those who are coming up.

“The cultural thing is always bigger than the product,†he says.

At AIA, it’s doing the right thing in the right way with the right people. If someone delivers results in the wrong way, we do not hesitate to take action. Sometimes organisations focus too much on results instead of the people.

Throughout the course of the interview, Ng has been unassuming about his accomplishments but as we wind down, allows himself a small triumph. “I play a round of golf every week,†he says when asked what he does in his spare time. “I’m what they call a struggling 10.â€

In real life, Ng is hardly struggling, given his propensity for problem-solving and his calm demeanour. If anything, he’s ready to step up to the plate. “I hardly give interviews – very little over the last couple of years because Mark was at the forefront,†he says as we shake hands. “But all leaders have to start somewhere.â€

TEXT MINDY TEH

ART DIRECTION PENNY CHEW

PHOTOGRAPHY KIM MUN / HOPSCOTCH PHOTOGRAPHY